Earthquake Insurance – Coverage for the Unexpected

When The Ground Shakes

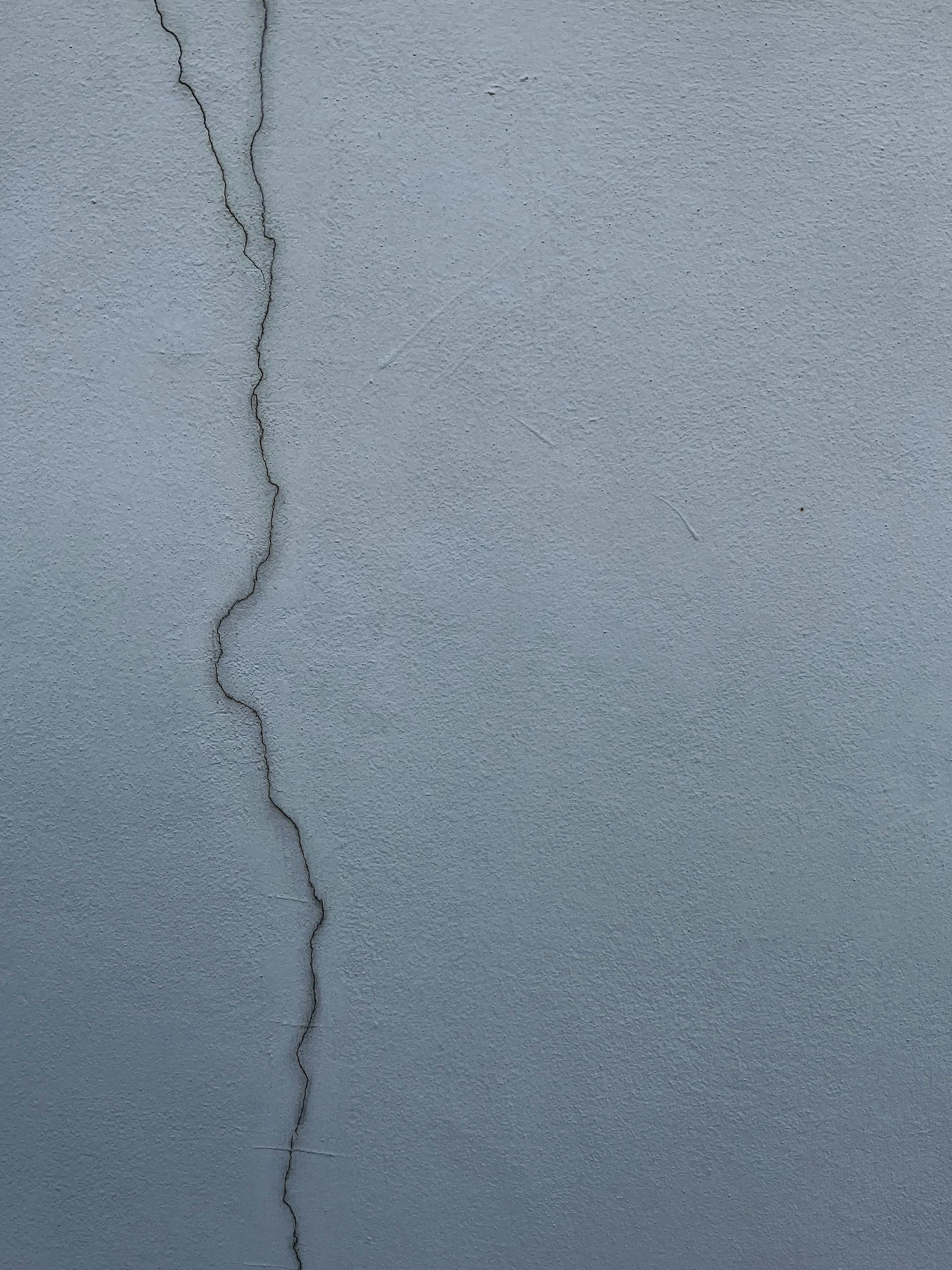

Wisconsin isn’t known for frequent quakes, but small seismic events happen in the Midwest. Because standard home policies exclude earth movement,

earthquake insurance Wisconsin gives Fox Valley homeowners a way to plan for low-probability, high-cost damage—foundation cracks, masonry repairs, and temporary living expenses—without leaving a gap in protection.

What Earthquake Coverage Includes

Endorsements or stand-alone policies can cover your structure, built-ins, and personal property after a covered quake, along with additional living expenses if the home is uninhabitable. Deductibles are typically a percentage of insured value; we’ll help you choose an amount that fits your comfort level and budget.

Assessing Your Need In The Fox Valley

Older masonry homes, unique foundations, or simply a desire for complete planning may justify adding earthquake protection. Head Insurance Agency compares carriers that write quake coverage in Wisconsin and coordinates with your homeowners insurance so policy terms work together.

Earthquake Insurance Questions, Answered

Is it expensive in Wisconsin?

Generally modest compared to high-risk states.

Does it cover sinkholes or landslides?

Those perils are typically separate; we’ll clarify options.

Can I add it to my home policy?

Some carriers offer endorsements; others use separate policies.

Have there been quakes here?

Historically minor, but coverage prepares you for the unexpected.